Significance of Economic Indicators

A notable shift is underway, reshaping the strategies and perceptions of institutional multifamily investors and professionals. Although CRE headlines have often focused on the potential timing and catalyst of the first Federal Reserve interest rate cut, housing experts are increasingly recognizing employment stability as the next key determinant of multifamily property values.

While interest rate policy is crucial, it's important to pay attention to fundamental macroeconolomic indicators. This includes full-time job reports, consumer sentiment, and household formation volume. Looking ahead, a scenario in which employment significantly declines could counteract the benefits to multifamily values from rapid interest rate cuts exerting downward pressure on commercial mortgage and cap rates.

Impact of Employment on Multifamily Values

Conversely, a scenario with higher rates for longer, without job growth or with a moderate rise in unemployment, raises concerns since rent growth is necessary to maintain values in the short term, especially with elevated commercial mortgage rates. A closer look at job reports reveals that, despite rapid interest rate hikes and major tech sector layoffs, full-time employment has remained surprisingly resilient.

Timber Hollow Apartments, Fairfield, OH

Policymakers have indicated that the effects of rate hikes take about nine months to influence the labor market. With 24 months since the first increase and nearly nine months since the last Fed Funds rate hike in July, the labor market is showing signs of avoiding a sharp decrease in full-time employment, despite potential threats to economic growth.

Inflation, Recession, and Economic Threats

Recession risks are always present, and real estate typically weathers them well. However, avoiding a recession due to aggressive interest rate hikes would remove a significant economic threat. Although inflation is slowing, most economists expect it to remain above 2% in the long term for essentials like shelter and food, as higher government debt, spending, and taxation become more prevalent.

This scenario of moderating inflation and growing full-time employment is unfolding. A resilient US labor market is beneficial for apartment owners, especially if interest rates gradually decrease, lenders tighten spreads, and rent growth normalizes from 2024 to 2026, varying by market.

From Fear to FOMO: The Changing Landscape

Recent resilient job reports and unemployment rates have led to market volatility, with stock prices often reacting inversely to positive employment news. Unlike stocks, multifamily real estate tends to respond more slowly to changes.

Moreover, multifamily values are more sensitive to interest rate fluctuations than stocks are. The past year's US stock market performance has boosted investor confidence, influencing decisions to allocate more capital into multifamily.

According to a panelist at the National Multifamily Housing Council (NMHC) annual meeting, the sentiment has shifted from "fear of making a mistake" in 2023 to "fear of missing out" in 2024.

Nuanced Investment Strategies

The divergence in investment behavior between stocks and real estate underscores the need for a nuanced approach. Now might be a good time to shift some capital from stocks to real estate.

Capital flows into U.S. stocks signal a shift from a "risk-off" to a "risk-on" investment strategy, as U.S. stocks reach new highs. For this shift to significantly affect multifamily property values, investors and lenders must believe the cyclical bottom has passed. Investors tend to act proactively, while lenders are slower to react. Real estate market changes take longer than stock market changes because mortgages and properties are long-term investments.

Multifamily lenders are starting to ease their cautionary measures for borrowers after assessing the impact of rate hikes on rental demand. Meanwhile, institutional investors are waiting for signs to avoid a hard landing before re-entering. However, private real estate investors remain cautiously optimistic.

Capitalizing on Long-Term Growth Potential

The disparity between stock and real estate investment behavior highlights the unique opportunity multifamily investments offer long-term investors to buy apartments near market lows. Waiting for broad recovery headlines could mean missing out on the right time to capitalize and, critically, on the quality of multifamily assets available.

A surge in capital can quickly make buying quality assets in desirable locations more challenging. Research and experience suggest that select undersupplied metros with strong local employment outlooks offer excellent buying opportunities for multifamily investors aiming for long-term growth.

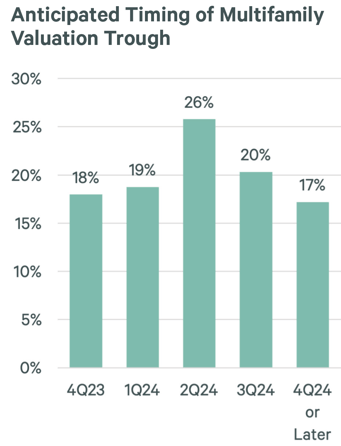

According to a CBRE survey from January 2024, 83% of respondents believe the multifamily market will bottom out before the end of Q3 2024.

Source: CBRE Survey of 130 active owners, operators, developers, and finance providers on the U.S. multifamily market. January 2024

Looking Toward Stability and Opportunities

Amid uncertainties surrounding interest rates, the resilience of employment levels stands out as a hopeful sign for apartment owners. A so-called soft landing in employment levels seems achievable, nearly nine months after the last rate hike.

As the investment landscape evolves, the resilience of employment offers a promising outlook for apartments. Every market is different, and RealSource has excelled in investing in the right market at the right time since 1989. We're excited about investing alongside our investors in new opportunities in our 2024 target markets.

Real Estate Risk Disclosure

• There is no guarantee that any strategy will be successful or achieve investment objectives including, among other things, profits, distributions, tax benefits, exit strategy, etc.;

• Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

• Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

• Potential for foreclosure – All financed real estate investments have potential for foreclosure;

• Illiquidity – These assets are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments.

• Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

• Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits

• Stated tax benefits – Any stated tax benefits are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

For more information on Emerson Equity, please visit FINRA’s BrokerCheck website. You can also download a copy of Emerson Equity’s Customer Relationship Summary to learn more about their role and services.

Important Disclosure

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the issuer, or any affiliate, or partner thereof ("Issuer"). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to any “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. All investments carry the risk of loss of some or all of the principal invested. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM for the respective offering. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. All offerings are intended only for accredited investors unless otherwise specified. Past performance is no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities through Emerson Equity LLC Member: FINRA/SIPC. Only available in states where Emerson Equity LLC is registered. Emerson Equity LLC is not affiliated with any other entities identified in this communication.